May 04, 2009, 07:33 PM

Bill KoskiWell what do you know, the voter registration fraud practitioners from acorn in Vegas have been indicted on multiple counts of voter registration fraud!!!!!!!!!!!!!!!!!

What this invariably means is the taxpayers hard earned money will be used to pay fines!!!!!!!!!!!!

They were doing the same things all over the nation, why aren't they being indicted else where??????????????

Two (2) of the galoots may be in a little deeper and may actually get to spend some time at the states expense!

May 06, 2009, 12:19 AM

Bill KoskiPoor 'ole spectacle found out pronto what a thieving den of liars he signed on with!

dingy harry faithfully promised the dupe he could carry his committee senority with him.

GUESS WHAT, DIDN'T HAPPEN!!!!!!!!!!!!!

He is now low socialist donkey in committee!!!!!!!!!!!!!!!

To top that the socialist donkies are already threatening him for speaking out the way he freely did with the Republicans!!!!!!!!

Surely the weiny GOP won't take him back??????????????

May 06, 2009, 10:14 PM

David Coveyquote:

Originally posted by Bob H:

Dave.. When you filed for unemployment when you lost your job, did they consider your monthly check from the govt plus your disability check when computing your unemployment benefits?

My retirement has nothing to do with earned income, although they still take all their taxes out of it.

I didn't file for unemployment. As far as the gubment is concerned I'm retired with no other income. But, no that isn't part of the formula unless you start drawing a retirement income after you become unemployed.

So the Social Security receipients and I will have to pay back the "stimulus" money Nobama is letting us keep for now.

I will be alright when he takes it back but what about those who have only their SS to live on that think this is a permanent increase?

I get stimulated every time I think of it!!

Dave

May 07, 2009, 12:54 PM

Bill KoskiThe socialist donkies in the Senate are in full shuck and jive mode!

Last week spectacle was going to keep his committee senority, yesterday he wasn't, today he has senority on one (1) committee??????

What's next????????

Then he royally secrewed up and said Coleman should be declared the winner by the court in the Minnesota Senate race, dingy harry braced him and spectacle said he (FORGOT?) what team he was on???????????

So once and for all you must lie and condone voter fraud to be on dingy harry's team!!!!!!!!!!!!!!!!

May 07, 2009, 07:34 PM

David Coveyquote:

Originally posted by Bob H:

quote:

I will be alright when he takes it back but what about those who have only their SS to live on that think this is a permanent increase?

Its being billed as a one time 2009 addition.

IMO

Who knows what happens next year.

Where did you read it gets paid back for the ppl on SS with no other income?

I understand it's a 2009 deal, but my dad and likely other older folks who don't pay attention to politics may think it is a permanent deal.. This would hit dad hard if he had to pay the money back, based on what he gets from SS..

It was an AP article that I got from my military.com newsletter. Here it is:

Taxpayers to Get Rude Surprise

May 04, 2009

Associated Press

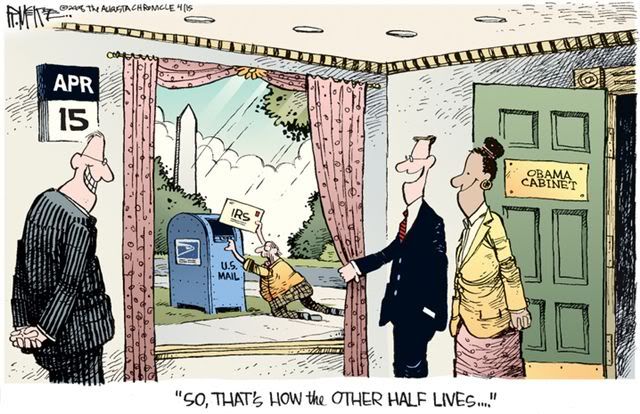

WASHINGTON - Millions of Americans enjoying their small windfall from President Barack Obama's "Making Work Pay" tax credit are in for an unpleasant surprise next spring.

The government is going to want some of that money back.

The tax credit is supposed to provide up to $400 to individuals and $800 to married couples as part of the massive economic recovery package enacted in February. Most workers started receiving the credit through small increases in their paychecks in the past month.

But new tax withholding tables issued by the IRS could cause millions of taxpayers to get hundreds of dollars more than they are entitled to under the credit, money that will have to be repaid at tax time.

At-risk taxpayers include a broad swath of the public: married couples in which both spouses work; workers with more than one job; retirees who have federal income taxes withheld from their pension payments and Social Security recipients with jobs that provide taxable income.

The Internal Revenue Service acknowledges problems with the withholding tables but has done little to warn average taxpayers.

"They need to get the Goodyear blimp out there on this," said Tom Ochsenschlager, vice president of taxation for the American Institute of Certified Public Accountants.

For many, the new tax tables will simply mean smaller-than-expected tax refunds next year, IRS spokesman Terry Lemons said. The average refund was nearly $2,700 this year.

But taxpayers who calculate their withholding so they get only small refunds could face an unwelcome tax bill next April, said Jackie Perlman, an analyst with the Tax Institute at H&R Block.

"They are going to get a surprise," she said.

Perlman's advice: check your federal withholding to make sure sufficient taxes are being taken out of your pay. If you are married and both spouses work, you might consider having taxes withheld at the higher rate for single filers. If you have multiple jobs, you might consider having extra taxes withheld by one of your employers. You can make that request with a Form W-4.

The IRS has a calculator on its Web site to help taxpayers figure withholding. So do many private tax preparers.

Obama has touted the tax credit as one of the big achievements of his first 100 days in office, boasting that 95 percent of working families will qualify in 2009 and 2010.

The credit pays workers 6.2 percent of their earned income, up to a maximum of $400 for individuals and $800 for married couples who file jointly. Individuals making more $95,000 and couples making more than $190,000 are ineligible.

The tax credit was designed to help boost the economy by getting more money to consumers in their regular paychecks. Employers were required to start using the new withholding tables by April 1.

The tables, however, don't take into account several common categories of taxpayers, experts said.

For example:

-A single worker with two jobs making $20,000 a year at each job will get a $400 boost in take-home pay at each of them, for a total of $800. That worker, however, is eligible for a maximum credit of $400, so the remaining $400 will have to be paid back at tax time - either through a smaller refund or a payment to the IRS.

The IRS recognized there could be a similar problem for married couples if both spouses work, so it adjusted the withholding tables. The fix, however, was imperfect.

- A married couple with a combined income of $50,000 is eligible for an $800 credit. However, if both spouses work and make more than $13,000, the new withholding tables give them each a $600 boost - for a total of $1,200.

There were 33 million married couples in 2008 in which both spouses worked. That's 55 percent of all married couples, according to the Census Bureau.

- A single college student with a part-time job making $10,000 would get a $400 boost in pay. However, if that student is claimed as a dependent on a parent's tax return, she doesn't qualify for the credit and would have to repay it when she files next year.

Some retirees face even bigger headaches.

The Social Security Administration is sending out $250 payments to more than 50 million retirees in May as part of the economic stimulus package. The payments will go to people who receive Social Security, Supplemental Security Income, railroad retirement benefits or veteran's disability benefits.

The payments are meant to provide a boost for people who don't qualify for the tax credit. However, they will go to retirees even if they have earned income and receive the credit. Those retirees will have the $250 payment deducted from their tax credit - but not until they file their tax returns next year, long after the money may have been spent.

Retirees who have federal income taxes withheld from pension benefits also are getting an income boost as a result of the new withholding tables. However, pension benefits are not earned income, so they don't qualify for the tax credit. That money will have to paid back next year when tax returns are filed.

More than 20 million retirees and survivors receive payments from defined benefit pension plans, according to the Employee Benefit Research Institute. However, it is unclear how many have federal taxes withheld from their payments.

The American Federation of State, County and Municipal Employees union raised concerns about the effect of the tax credit on pension payments in a letter to Treasury Secretary Timothy Geithner in March.

Geithner responded that Treasury and IRS understood the concerns and were "exploring ways to mitigate that effect."

Rep. Dave Camp of Michigan, the top Republican on the tax-writing House Ways and Means Committee, said Geithner has yet to respond to concerns raised by committee members.

"So far we've got the, 'If we don't address this maybe it will go away' approach," Camp said.

Dave